The reason no interest at a positive or at a negative rate is paid on currency is that it. Put simply if your contract with the bank stipulated for instance a 2 annual rate on your deposit and the inflation rate reached 4 in that year youd have incurred a real loss.

The introduction of a negative interest rate will see these bonds yield fall further and possibly encourage investors to move away from bonds and look at other safe investments.

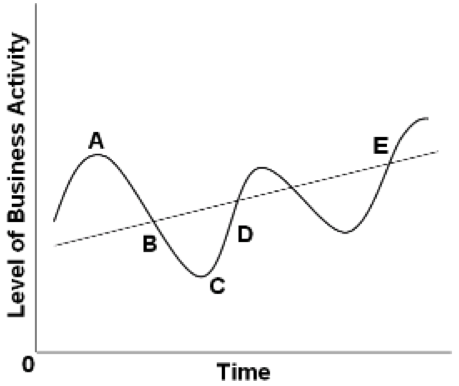

. Encourage consumption by discouraging saving. Bcompete with private banks in the lending market. During poor economic performance seasons negative nominal interest rates are adoptable.

Governments imposing negative nominal interest rates are attempting to discourage the use of banks. It used to be and perhaps still is standard to teach in economics classes that the nominal interest rate cannot possibly be negative. As long as all interest rates move in tandem including the rate of return on paper currency economic theory suggests no important difference between interest rate changes in the positive region and interest rate changes in the negative regionIndeed in standard models only the real interest rate and spreads between real interest rates matter.

Governments imposing negative nominal interest rates are attempting to A. This is also likely to increase investment in gold. Encourage consumption by discouraging saving.

Discourage the use of banks. Interest rates are now negative below zero for a growing number of borrowers mainly in the financial markets. In such a situation we say the real interest ratethe nominal rate minus the rate of inflationis negative.

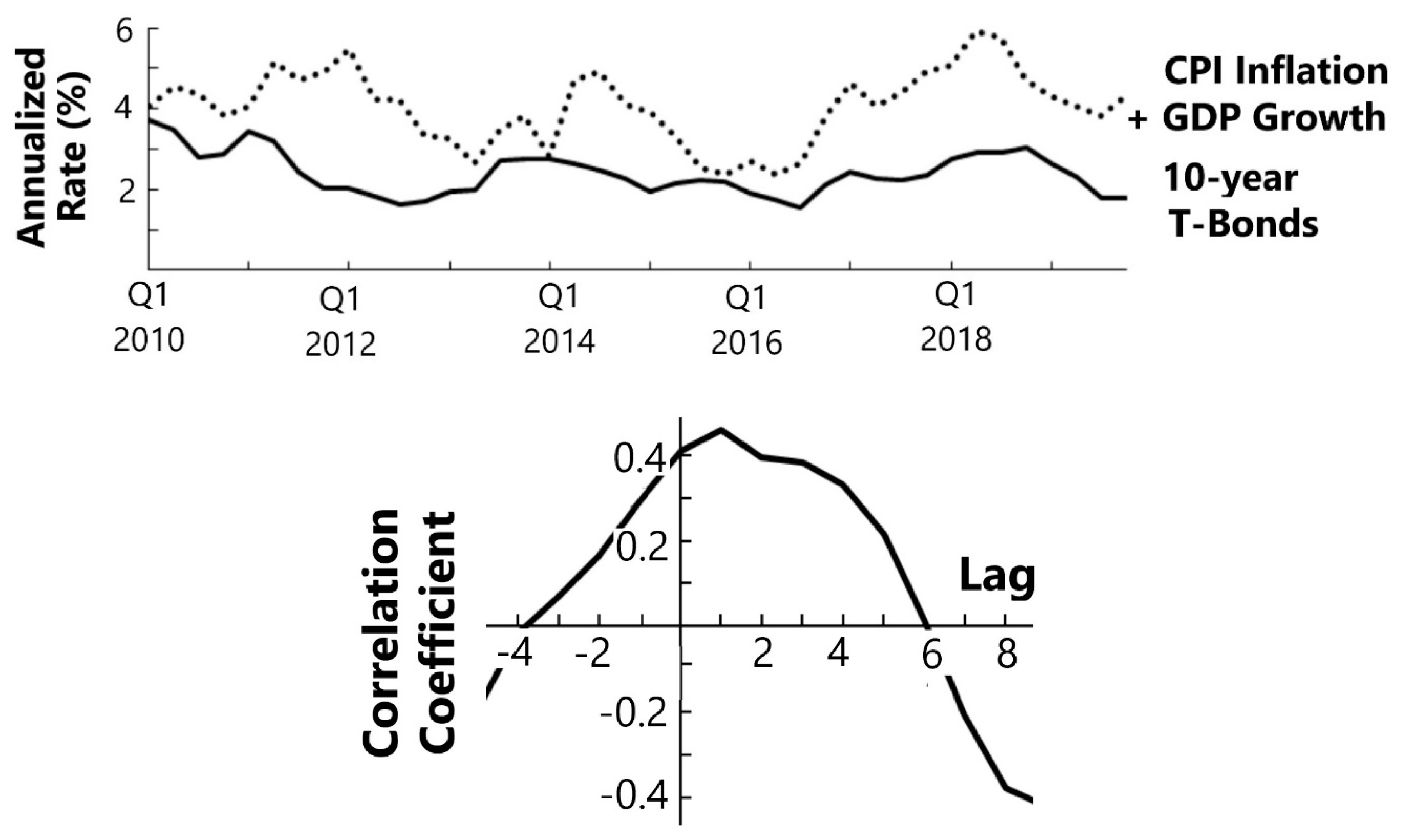

Interest rates 1990-2020 of 10-year government bonds for. However consider what happens when the rate of inflation exceeds the return on savings or loans. A negative interest rate policy NIRP is an unconventional monetary policy tool employed by a central bank whereby nominal target interest rates.

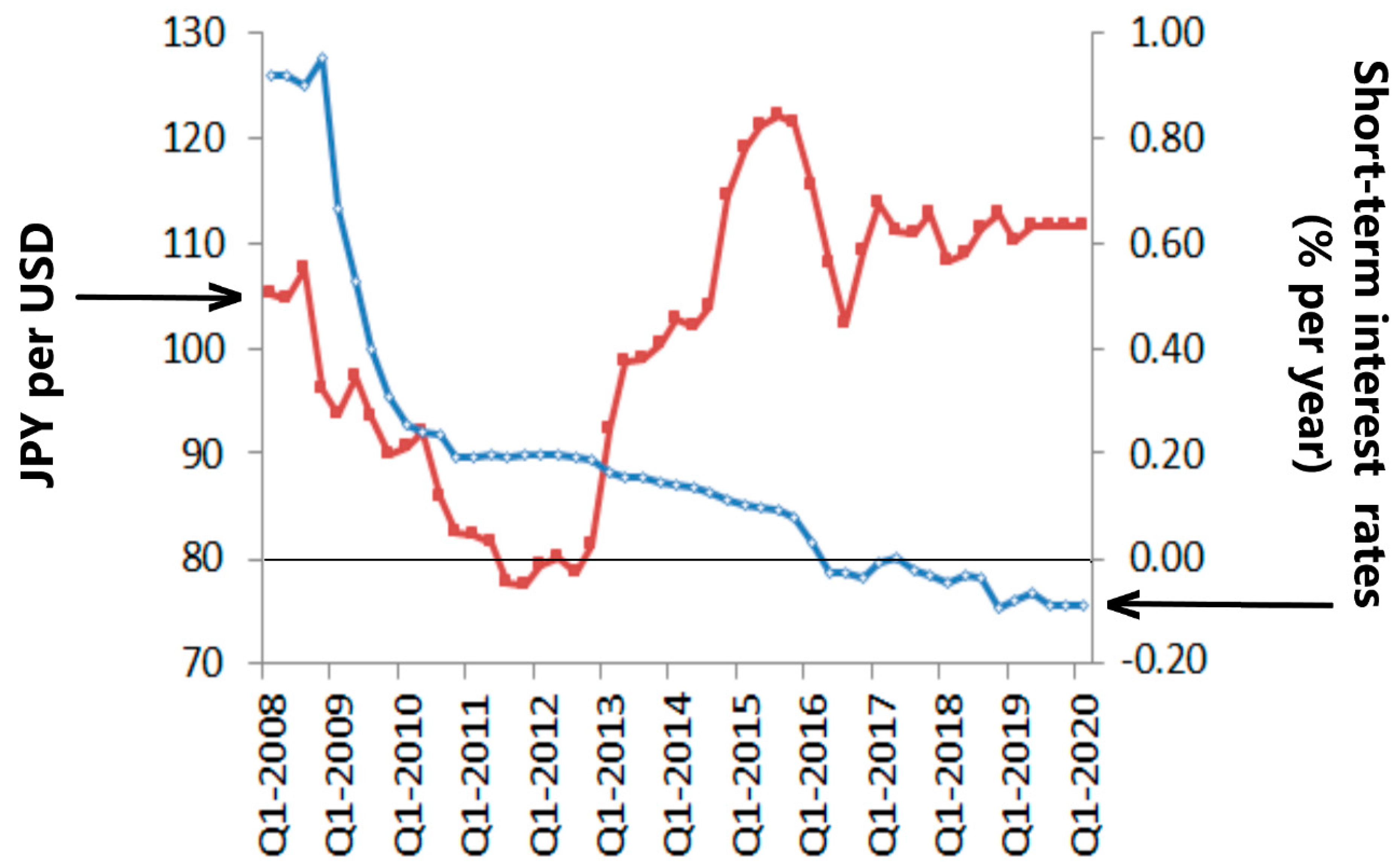

Negative nominal rates mean that private banks are charged for storing money in the central bank a cost that private banks have only passed on to their large-sum depositors and savers so far. There is an obsession with negative nominal interest rates. I assume that the central bank uses the inter-est rate as its policy instrument and follows a Taylor rule.

Dencourage consumption by discouraging saving. Recently attention has focused on the large volume of long-term bonds with negative nominal yields see chart. Discourage consumption and encourage saving.

This includes not just interest rates on electronic reserves but also on government bonds. QUESTION 13 Governments imposing negative nominal interest rates are attempting to discourage the use of banks. Cdiscourage consumption and encourage saving.

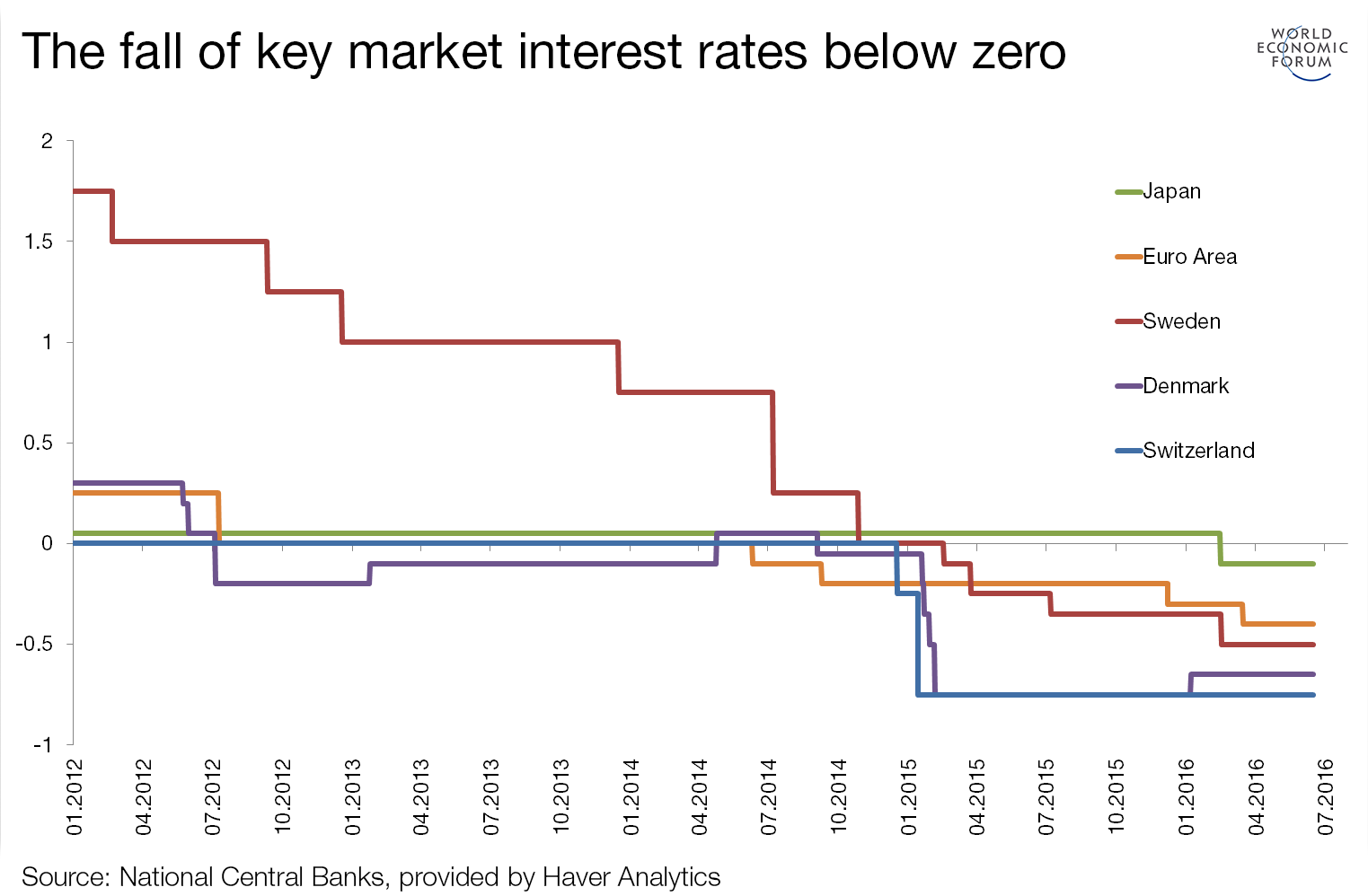

Today short-term money market rates in Denmark Germany and much of the euro area Japan Sweden and Switzerland all remain below zero see chart. For instance in 2014 the European Central Bank adopted a -01 interest rate on deposits held. This was not caused by nominally negative interest rates but rather by the fact that contractual nominal interest rates were lower than the rate of inflation.

Discourage consumption and encourage saving. Dencourage consumption by discouraging saving. People seem to think that they make no sense.

Economists argue that nominal interest rates should not be negative. Discourage consumption and encourage saving. Compete with private banks in the lending market.

Although rich central banks have begun imposing negative interest rates such actions have not been practiced previously. For most developed economies including Australia official interest rates are currently below 3 meaning that Central Banks have limited scope to use interest rate policy if an economic shock eventuates given that negative nominal official interest rates below -075 have never been implemented anywhere and hence the full economic ramifications of taking. Treasury Bill with a negative nominal interest rate would be dominated by currency as a store of value.

Compete with private banks in the lending market. Governments imposing negative nominal interest rates are attempting to Adiscourage the use of banks. And there is a fixation with keeping track of the fraction of sovereign debt that is trading at negative nominal rates.

Governments imposing negative nominal interest rates are attempting to Adiscourage the use of banks. Bernanke 2012 argues that nominal interest rates are zero-bound essentially ruling out the possibility of negative nominal interest rates. Cdiscourage consumption and encourage saving.

The Bank of Japan BOJ keeps trying to print Japan back to economic prosperity and it is not letting 25 years of failed stimulus policies get in. Yet as of mid-2016 the government bonds reflecting about one-third of global economy had negative nominal interest rates the Euro area Japan Sweden Denmark and Switzerland. At this writing the number is approaching one-third of the total outs.

It also means that government bonds issued with negative returns will result in bondholders receiving a total amount of interest below the price they paid for this debt. Nominal three-month interbank rates 2007-October 2019. The difference in those two situations is the subject of money illusionthe behavioral tendency of people to think in nominal terms.

4 Rt rl3 F7T - Tr. Governments imposing negative nominal interest rates are attempting to encourage consumption by discouraging saving Unemployment rates in the United States from 2005 to. If the UK introduces negative interest rates the value of gold is likely to increase.

Where Rt is the one-period nominal interest rate Wt is nominal wealth at the beginning of period t Ht are nominal transfers from the government taxes if negative and Pt is the price level in period t. When inflation is 3 percent and the interest rate on a loan is 2 percent the lenders return after inflation is less than zero. Encourage consumption by discouraging saving.

So why have some nominal interest rates gone negative. There would be a simple pure arbitrage opportunity for anyone able to borrow at a negative nominal interest rate and invest in currency. Compete with private banks in the lending market.

It means in effect they are. 5 To the extent that money illusion is operative then imposing negative nominal interest rates will be perceived as more costly to people than engineering an increase in inflation of the same amountin both.

Jrfm Free Full Text Negative Interest Rates Html

Jrfm Free Full Text Negative Interest Rates Html

Negative Interest Rates Absolutely Everything You Need To Know World Economic Forum

If The Real Interest Rate And The Nominal Interest Rate Are Both Negative And Course Hero

0 comments

Post a Comment